Token Economics/Token Engineering have been around as it goes through the system of economics based on blockchain technology. Every blockchain platform and application is involved with its own token economic model. Generally, there is an assumption where majority of token economic models are based in: people act upon incentives. This comes from the incentive theory wherein it is assumed that behavior is brought on by a desire for incentives or reinforcements. With token economics, the incentives are the tokens themselves. These are used to drive network members to behave for the network’s benefit.

Today we will be discussing new token economic models and techniques used with a focus on Bounding Curves and Continuous Token Models.

Definition

continuous token

Continuous Token

These are a new type of token that is managed through bonding curve contracts. These are named so because of its price being continuously calculated. Continuous tokens have properties such as the following:

Limitless Supply

There are no limits of token quantity that can be minted

Deterministic Price

The prices of buy and sell tokens increase and decrease depending on the token numbers minted.

Continuous Price

The price of the token n is lower than token n+1 and higher than token n-1.

Instant Liquidity

Tokens can be bought and sold in an instant anytime. The bonding curve acts as the automated market maker. The bonding curve contract stands as the counterparty of the whole transaction which means it also always has enough ETH stored to buy the tokens back.

All these are possible because of bonding curve usage.

bonding curve

Bonding Curves

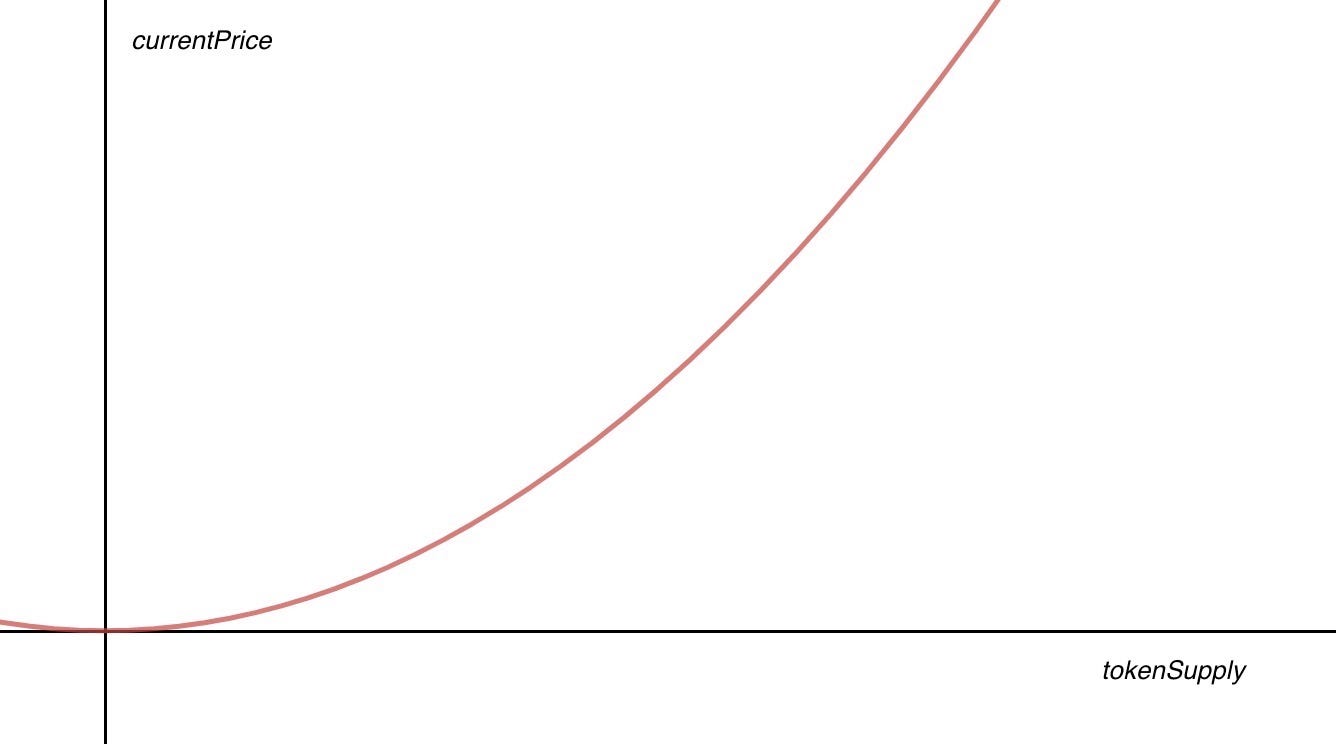

Meanwhile, a bonding curve is defined as the mathematical curve that shows the relationship of price and token supply. Below is an example of the bonding curve wherein

currentPrice = tokenSupply²:

bonding curve

The bonding curve indicates that the price increases while the token supply also increases. With this exponential curve case, growth rates increase and accelerate with the number of tokens minted. When someone buys a continuous token, every subsequent buyer has to pay a slightly increased price for every token to generate profit for earlier investors. With more people looking into the project and buying tokes, the token value constantly increases with the bonding curve. Therefore, the early investors who found and bought the continuous token early can sell their token back later on and earn a profit.

Bonding Curves in Blockchain

We can take these curves onto blockchain. The bonding curve contract is a specific type of contract that makes its own continuous token. The prices are calculated based on the contract and the bonding curve.

The contract of the bonding curve holds the balance of the Reserve Token. In order to purchase Continuous Tokens, the buyer will send an amount of ETH to a bonding curve’s contract Buy Function. This will then compute the token price in an ETH and will then issue the right amount of Continuous Tokens.

Meanwhile, the Sell function works backwards wherein contracts calculate the Continuous Token’s current selling price. From there, they will send the right amount of ETH.

Bonding Curves Case Study

Now that we’ve learned about continuous tokens and bonding curves, it’s time to find out what we can build with it.

In order to make a successful decentralized system, there needs to be design incentives to encourage the network participants. This is so they will act in a way that will bring upon a win-win situation. The goal is to ease people into doing the right thing and make it a struggle to do the wrong one. Here are the cases in which bonding curves are used:

automated market maker

1 / Automated Market Makers

In a normal cryptocurrency exchange, Market Makers create buy or sell orders specified for a token exchange pair. Market Takers fill the participant orders t odo the exchange.

With this workflow, it requires a matching process for exchanges to happen. Market markers have to create orders that will be published on exchanges. Market takers have to look through orders and need to wait for it to get filled. Since both boy and sell orders have prices on them, market fluctuations may cause orders to take time to get filled.

How Automated Market Makers work

Every Automated Market Maker contract will have the balance of a Reserve Token. Buyers can then use this reserve token to buy a Continuous Token managed by the AMM. They can do so by sending a Automated Market Maker contract. This will add the incoming amount to the reserve token balance and issue new Continuous Tokens. These are sent back to the buyer.

Anyone has the chance to buy a Continuous Token anytime just by depositing a certain amount of the reserve token into the smart contract. At the same time, a seller has the ability to send back any amount to its contract which can remove the Continuous Tokens from circulation. It will also withdraw the same amount of Reserve Tokes from the AMM’s balance and return them to the seller. This ends up with both AMM’s Reserve Token Balance and Continuous Token’s supply to decrease.

TCR

2 / Token Curated Registries

These are decentralized-curated lists that have intrinsic economic incentives for the the token holders to filter the list content. It’s an emerging cryptoeconomic primitive that lets distributed communities self-organize something with a singular goal.

This token-curated registry makes use of a native token to assign curation rights in proportion with the relative token weight of the entities that have the toke. There are incentives rewarded to someone whenever they curate items that should or shouldn’t be on the list. The product of this token-curated registry is a list like “Top 100 Classical Songs in America” or a whitelist of trusted entities.

Participants of TCR have to pay for tokens if they want to change something on the list. If they abuse the position or if their list is unpopular then they lose the token. There can be appeals made but they will cost you so making malicious attempts will be punished.

As long as there are members who want to be chosen into a list, the market exists wherein incentives of rational token holders are in line towards creating a high quality list.

Conclusion

We discussed bonding curves and where it’s being used. TCR’s are a cryptoeconomic primitive that is useful in helping you create incentives in networks that are decentralized. At the same time, the exact science of creating proper incentive structures is still a field that has many challenges? What kind token economic design will bring upon a healthy decentralized network?

With the progress of bonding curves, people will start to be motivated towards creating incentivized and adversarial games that will bring upon successful decentralized communities.